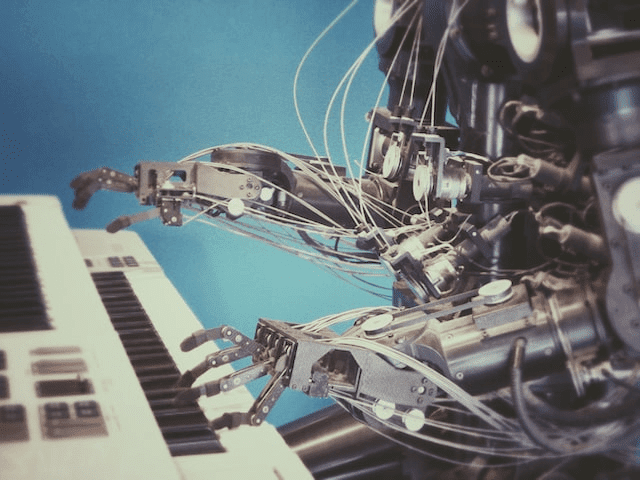

The insurance sector primarily reduces risks and provides various financial coverages, forecasting the future. Many companies have adapted and implemented technological innovations in their systems to meet the industry’s ever-rising demands and regulatory compliances. Artificial Intelligence is not new in this landscape. It has been used previously for forecasting data, modeling risks, handling claims, and contact center operations.

What are the most prominent applications of AI in insurance at present?

At present, AI has contributed to the insurance sector in multiple ways. It has:

- Enabled precise predictions

- Controlled customer interactions

- Expanded personalized service and product lines

- Increased efficiency with unprecedented accuracy and speed

- Simulated future scenarios

- Improved the accuracy of risk estimation

- Motivated better pricing

How is AI improving the future of the insurance industry?

Artificial intelligence offers accurate risk assessment and personalized policies within a very short span. Moreover, flagging falsities increases the reliability of the business, all of which leads to better experiences and enhanced customer satisfaction.

Increased precision in assessing risk and underwriting

AI models analyze and process data a hundred times faster than the previously used methods. This allows for nearly instant assessment of risks. Insurers get to offer personalized and precise policies utilizing heightened speed and accuracy. Moreover, the assessments include instantly available data from social media, IoT devices, and many other sources. This provides a comprehensive perspective of the risk factors. In addition, it reduces the time to investigate risks by 90%. It makes the process thorough, clear, and reliable.

An article published in Avenga reflected that the industry players who used AI to assess risk reported a 25% increase in risk prediction accuracy. AI-assisted tools for risk assessment also drastically minimize the chances of prediction errors. This leads to more customized policies in the insurance and reinsurance market that successfully address customer requirements and reduce redundant payouts.

AI algorithms offer distinct underwriting by examining a broader data point range than previous methods. AI-aided underwriting reduces the entire processing time to minutes, helping insurers to save substantially. It also leads to customer satisfaction with instant service. Insurance companies use AI to evaluate a prospective customer’s driving habits through telematics data, ensuring that the policy provided is correctly priced based on actual risk. A Deloitte study mentions that AI-integrated processes of underwriting minimize expenses by up to 50%.

Dun & Bradstreet and Databricks’ collaboration to deliver instant global dataset access

Dun & Bradstreet, a global forerunner in data analytics of business decisions, collaborated with Databricks to deliver its comprehensive business data and analytics on hundreds of millions of commercial entities and businesses across the globe, through Databricks Marketplace. The partnership utilized the intelligence platform of Databricks to access and scale up Dun & Bradstreet’s in-depth datasets and analytical insights.

Partnerships in 2022 among prominent companies that adopted AI

In April 2022, CLARA Analytics released CLARA Optics, a software using AI and ML to streamline bills and medical documents. This created a claim-based medical record and helped to provide AI technology for the commercial insurance industry. Two months later, MS&AD and Akur8 partnered to reform insurance pricing with transparent AI. The partnership encouraged further innovation and development processes by automating risk modeling.

Efficient fraud detection leads to increased business credibility

AI accurately detects fraudulent claims aiding insurers to save money and uphold the credibility of their services. It analyzes claim data patterns to identify oddities including frequent small claims from a single source or unusually high claims. ML models are also trained to spot these patterns and mark dubious claims for further scrutiny. Furthermore, AI betters claim process analysis by automating and improving fraud detection. These developments led to quicker claim resolves, reduced functional costs, and notably diminished fraudulent claims. According to Allied Market Research, these factors have contributed largely to the growth of the AI in insurance market.

Teradata and FICO partnered to reduce fraud and improve business outcomes in May 2023

Teradata and FICO announced an agreement in May 2023. It planned to bring to industry integrated advanced analytic solutions for insurance claims, supply chain optimization, and real-time payment fraud. The resulting solutions delivered reduced costs, improved profits, reduced risk, and greater customer satisfaction for Teradata/FICO customers.

Endnote

AI’s potential in insurance rests in its ability to derive novel insights from complicated actuarial and claims datasets. This technology continues to mature, and the increase in use cases further contributes to innovations in Insurtech. Their ability to inform input data provenance and ensure data quality is expected to contribute toward a safe and controlled application of AI to the insurance industry.

✍ **𝑨𝒓𝒕𝒊𝒄𝒍𝒆 𝒘𝒓𝒊𝒕𝒆𝒓: Saranya Ganguly

Author’s Bio:

Saranya Ganguly is a B2B writer with extensive experience in crafting research-driven content.

The knack for blending insights and statistics with creative flair motivates her to deliver engaging, and impactful write-ups. She specializes in web articles, newsletters, promotional pieces, and LinkedIn briefs, helping businesses articulate their brand voice and value propositions. A master’s degree holder in English and Commonwealth Literature, Saranya enjoys reading in her free time. When not writing, she dabbles in photography and fine art.