QuickBooks is an accounting software that helps small businesses and self-employed individuals manage their finances in an organized and efficient manner. It is one of the most popular accounting software programs in the market. It is an advanced tool that includes features for invoicing, tracking expenses, generating reports, and managing payroll.

QuickBooks is a cloud-based software, which means we can access it from any device with an internet connection.

This is convenient for businesses that need to manage their finances on the go, or for those who do not have the resources to invest in an on-premises accounting solution. Once we have signed up and logged into QuickBooks, we will be greeted by the home screen, which serves as the dashboard for our accounting activities.

From here, we can access all the features and tools available in QuickBooks, including the Chart of Accounts, Invoicing, Expenses, and Reports.

In this blog post, we will explore how QuickBooks works and the different features it offers to help us manage our accounting needs.

Features of QuickBooks

The Chart of Accounts: It is a list of all the financial accounts, such as cash, accounts receivable, and inventory. We can add, edit, or delete accounts as needed, and can also assign them to different categories, such as income, expenses, or assets. The Chart of Accounts is important because it helps us track our financial transactions and understand the financial health of our business.

Invoicing: this is a feature that allows us to create and send invoices to our customers. We can add items or services to the invoice, specify the payment terms, and even attach documents or notes to the invoice. We can also set up recurring invoices for regular customers and monitor their payment status.

Expenses: this is a feature that helps us track and manage our business expenses, such as supplies, travel, or rent. We can add expenses manually or import them from our bank or credit card account. We can also categorize expenses by types, such as marketing or rent, and we can attach receipts or documents to each expense. This feature is useful for preparing tax returns or creating expense reports for a business.

Reports: this is a feature that allows us to generate various financial reports, such as profit and loss, balance sheet, or cash flow. We can customize the reports by date range, account, or category, and we can export them to Excel or PDF for further analysis or sharing. Reports are a useful tool for understanding business performance and for making informed decisions.

In addition to these core features, QuickBooks offers several integrations and tools to help us manage our accounting needs. In addition to the software itself, QuickBooks also offers a range of professional services to help businesses with their accounting needs.

One such service is QuickBooks accounting services, designed to help businesses with their accounting and financial management. These services can be especially beneficial for small businesses that do not have the resources or expertise to handle their accounting in-house.

Another service offered by QuickBooks is the QuickBooks clean up service, designed to help businesses get their QuickBooks accounts in order.

This service can be useful for businesses that have been using QuickBooks for a long time and have accumulated a large number of transactions and accounts. The clean-up service can help businesses organize their accounts, reconcile transactions, and fix any errors or discrepancies.

Find Out How QuickBooks Works

- Set up your business: To get started, we’ll need to create a company file in QuickBooks and enter our business’s name, address, and other essential information.

- Enter transactions: QuickBooks allows us to keep track of our financial transactions, including sales, expenses, and payments. We can enter these transactions manually or import them from other sources, such as our bank account or credit card statements.

- Generate reports: QuickBooks allows us to generate a variety of reports, including profit and loss statements, balance sheets, and cash flow statements. These reports can help us track the financial performance of our business and make informed decisions.

- Manage payroll: If we have employees, QuickBooks can help us manage payroll, including calculating paychecks and tracking tax deductions.

- Collaborate with your team: QuickBooks allows us to invite team members and advisors to access our company file and collaborate on financial tasks.

- Integrations: QuickBooks integrates with a range of other tools and platforms, such as online payment processors and point-of-sale systems, making it easier to keep track of our financial data.

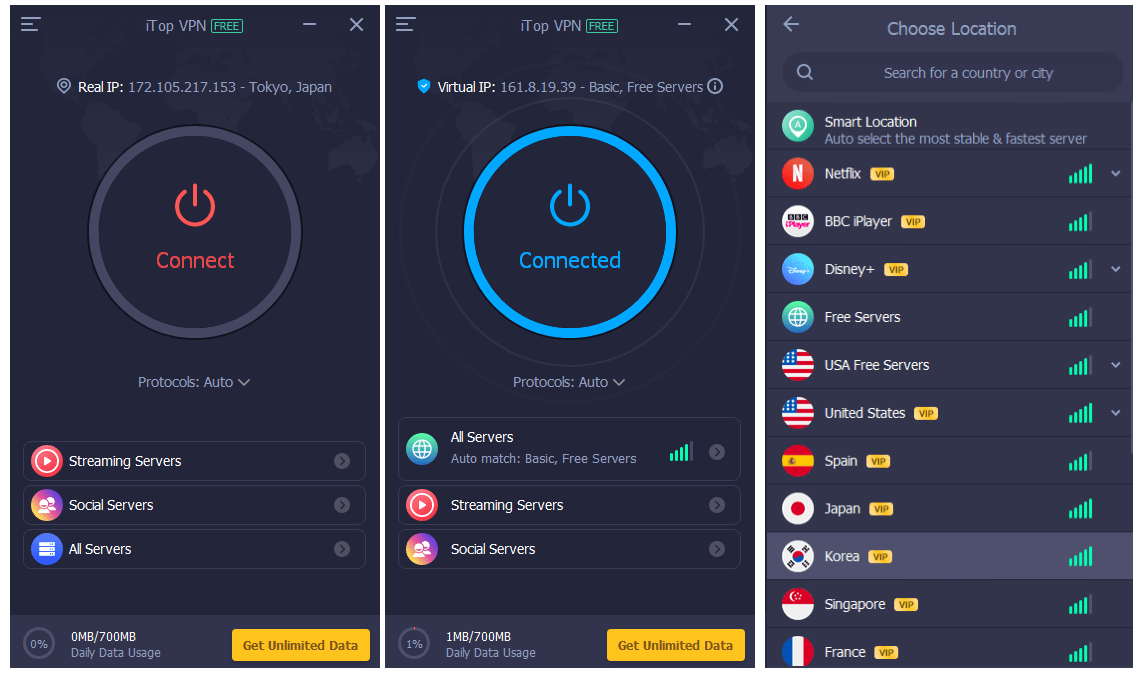

- Security: QuickBooks uses secure servers and encryption to protect our financial data.

The Conclusion

Overall, QuickBooks is a powerful and user-friendly accounting software that can help small businesses and self-employed individuals streamline their financial management. It offers a range of features and tools to handle invoicing, expenses, and reports, and it integrates with other business tools and platforms. QuickBooks is worth considering to have an easy and efficient way to manage accounting.