Everyone Wants Financial Freedom

Who does not want to have financial freedom? When we look at our professional activities, do we see them as endeavors catered to our passions? Or are they all just instruments for becoming financially stable? Do not get us wrong: we are not throwing doubt on your chosen path. We only recognize how our modern pursuits are strongly-linked to our financial well-being.

But what is financial well-being exactly?

A state of being financially stable, your financial well-being is at its best when you can effectively manage all economic aspects of your life. Financial well-being entails smooth management of your bills and expenses, preparedness for any emergency, and investment in personal development avenues such as tertiary education, business, property investments, and the like. If you have financial well-being, you can rise above unexpected economic challenges.

When you are in a state of financial well-being, you have the freedom to spend on things you want and need. People who work from 9 to 5 lack this freedom as they only expect to make ends meet until their next payout. Their economic situation leaves a lot to be desired.

While employers provide their workers with avenues to earn, the matter stands that not all of them will become financially stable. Due to this, many employees choose to leave companies they may have already been employed in for years. Or, if their stamina and age permit them, take on other jobs that do not overlap with their primary ones. Albeit laudable, these may diminish their quality of life.

Financial Technology or Fintech might be the key to their liberation. The fintech sector is seeing notable growth recently as several companies are starting to invest in the space heavily. In this light, fintech designs have become more intuitive and accessible even to the non-tech savvy.

A niche in fintech that is recently getting attention is employer-channel fintech.

Employer-channel fintech is a set of programs and solutions that support employees’ financial health. The niche helps employees overcome their financial difficulties.

Meanwhile, the niche’s outcomes see increased job satisfaction and productivity rates. These result in higher retention among employees and further growth for the company.

It is a win-win situation. Employers and employees reap the benefits of a well-facilitated and well-oiled employer-channel fintech machinery.

The following segment looks at the avenues the niche provides for employees’ financial wellness.

How Fintech Gets Employers Involved In Their Own Financial Well-Being

Submitting to an employer’s authority implies the employee’s complete trust. That said, with fintech, their trust is ideally validated. Not only does the employer pay for the work done, but the employer also opens the opportunity for financial literacy and control. In the employer-channel fintech niche, employers train and educate their employees. Here are some fintech solutions that serve the purpose.

1. Automated Paid-Time-Off (PTO) Tracking

Automating business procedures allow employees to focus more on tasks that develop them professionally. Automation minimizes possible incidents of human error, uncomplicates processes, and standardizes them.

When companies automate Paid Time Off (PTO) tracking, they allow monitoring of PTO requests. By automating PTO tracking, Human Resources Departments can easily track request submissions, approvals, and rejections. On top of that, the cloud or the company’s employee database saves these records for documentation. An automated PTO request system populates the PTO calendar with all standing requests. The system provides transparency as it lets all employees know when their colleagues will not be reporting for work.

Integrating automated PTO monitoring into the payroll system, allows recording and calculating of the hours worked. The system does away with manual tracking of time off from time accrued within the pay period. With this automated system, companies can perform effective budget tracking that helps employees efficiently utilize their PTOs.

2. Fintech Software That Monitors Employees’ Personal Credit

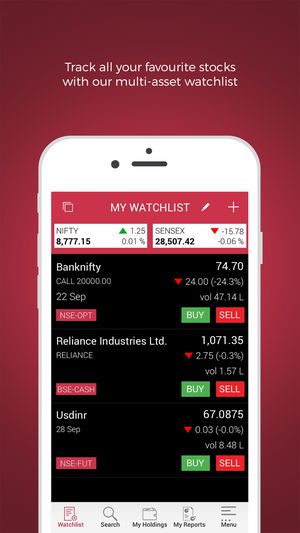

Employees are not always aware of the basics of personal credit. Through fintech, companies can imbue in them the importance of knowing their personal credit scores. The Human Resources Department should implement programs that allow employees to monitor them.

On top of this, the company can also use fintech apps and software that lets employees track their salary, deductions, loans, and current personal credit. Through these, employees can tailor their daily, weekly, and monthly spending habits. This allows them to think of fallbacks or solutions if ever they run into a financial emergency.

3. Apps To Track Personal Loan Applications

When employees make personal loan applications, companies can make the processes transparent by monitoring fintech apps. These apps provide updates in real-time so that employees know the status of their applications.

Employers can either enlist the services of a third party or have their in-house developers come up with software that automates the processes for application. Under the advice of the human resources department, the developers can integrate PTO monitoring, leave requests, and overtime requests to ascertain the eligibility of every employee. If possible, the app should also integrate a function that allows employees to see their personal credit standing.

4. Companies Should Also Act as Financial Advisors

Financial well-being also entails high levels of emotional intelligence. When one’s emotional quotient is low, people tend to spend irresponsibly.

An article published by Investopedia stipulates that financial responsibility requires that you spend only what you can afford. It is integral you spend less than what you earn.

Enamoured by the luxuries shown on social media, people usually spend on things that their salaries cannot buy. From apparel to travel, they are led to debt that can easily pile up, leaving them with no savings and able to pay only their utility bills.

Companies can train their employees to become emotionally intelligent by recommending them apps and software that will allow them to track their financial health.

They can also conduct training sessions on how to make investments in various asset classes through different types of trading techniques. Fintech apps that help these programs scaffold employees in putting them in charge of their finances.

Reliable Fintech Systems: The Key To Financial Well-Being

Much like conducting pricing surveys, understanding your personal credit means determining your value in the market. It decides if you will be allowed to get a personal loan or what type of car you can enter into bank financing. Your personal credit status is a good barometer of your financial well-being.

Achieving financial well-being takes work. There is no way around it. If you are an employer who sincerely wants to see your employees grow, training them to become financially literate should be among your priorities.

With the growth of the fintech sector, your business can provide the necessary avenues to help them out. Work with your human resources department to see what programs you can give your employees. You can also strike a deal with your software developers to create simple yet helpful apps and software that provides your employees transparency on processes and applications that concern finances. Additionally, you may reach out to third-party providers who can provide programs on financial literacy.

Whatever you choose to do, know that your employees trust your company with their hard work, expecting you could provide them with professional and financial growth.