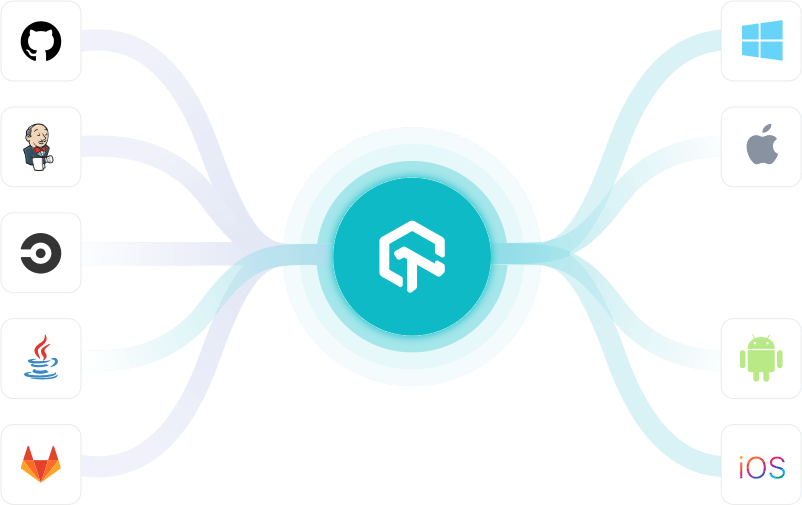

Decentralized finance and decentralized exchanges are revolutionizing the way that an individual can use money in a secure and efficient manner without the need for third-party involvement. Liquidity pools are taking the innovative decentralized finance approach further through enhancing decentralized exchanges through utilizing features such as Uniswap. Liquidity pools are fast becoming a fundamental component of DeFi and are a vital element of automated market makers, as well as yield farming, blockchain gaming, and borrow-lending protocols.

Liquidity Pools In DeFi

So, what are liquidity pools? Liquidity pools hold a series of assets that are held securely in a smart contract, enabling automated market makers to trade with no requirement for counterparties to be present. Liquidity providers additionally add to the pool and ensure an equal value, creating a market. Those who participate in the market and add to the crypto assets earn trading fees in response.

The Order Book Model

Traditional trades on the stock exchange, as well as exchanging cryptocurrency in a centralized manner, require a buyer or a seller to place an order, allowing a buyer to seek to pay a lower price whilst the seller will try to sell for a higher price. Ultimately, the buyer and the seller must agree on a price that they are both happy with, otherwise, the trade does not happen. This is called the Order Book model.

Sometimes, a buyer and a seller may not agree on a price, and so a Market Maker addresses this stalemate by agreeing to buy or sell a certain asset to inject liquidity into the situation and allow the trader to continue to trade. The trader does not have to wait for a buyer to appear who is interested in their asset.

The Benefits of Liquidity Pools

A liquidity pool works in decentralized finance to create a market for a pair of assets, allowing the liquidity provider to supply the assets and set the starting price. The higher the amount of liquidity placed in the liquidity pool determines the level of the transaction fee or profit that the liquidity provider receives, once split proportionally across the entirety of the pool. This provides an attraction and incentive for the liquidity provider to increase the amount of liquidity on the pool.

Considerations of Liquidity Pools

With any financial trading opportunity, there will always be a risk involved, and the risks involved in liquidity pools are no different. While the requirement for centralized order books is no longer necessary when using a liquidity pool, a loss of funds is still a real risk to consider, with volatility between trading pairs a possibility. A wider liquidity pool may also create slippage due to a reduced difference between price expectation and the actual trade price achieved. It is also important to be aware of smart contract reliance, which may increase your risk of being exposed to viruses, bugs, and exploitation online.