Technology has been the reason for financial markets from electronic trading in the 1970s to AI-powered analytics. Innovation keeps coming up with ways of altering how people engage with their stocks, commodities, or cryptocurrencies. The convergence of Artificial Intelligence and Blockchain in the United States is revolutionizing how stock and crypto trading apps work, changing an industry and opening new doors for both traders and developers.

This is more than a trend; it is a paradigm shift in how trading operates. AI and Blockchain address the dual needs of data-driven decision-making and secure, trustworthy transactions to set the stage for the next generation of financial platforms.

Role of AI and Blockchain in Trading Apps

Trading is built on two core aspects: data and trust. The right insights from which traders take their informed decisions depend on the platforms in place to ensure that the transactions conducted are sound. AI talks about the need for data-driven insight, while Blockchain deals with issues of trust and, in turn, focuses on transparency and security.

1. AI Enhances Decision-Making

With AI, one can handle large amounts of data in real time and, at the same time, analyze market trends and predict results. It makes traders operate more rapidly and effectively.

2. Blockchain Builds Trust

Blockchain technology secures transactions, ensures transparency, and prevents tampering. It gives traders peace of mind in volatile cryptocurrency markets.

Taken together, these technologies create very strong synergies that make the apps smart, fast, and secure. They are very quickly gaining momentum in the United States where markets are financially sound and citizens tech-friendly.

Impact of AI on Stock and Crypto Trading Apps

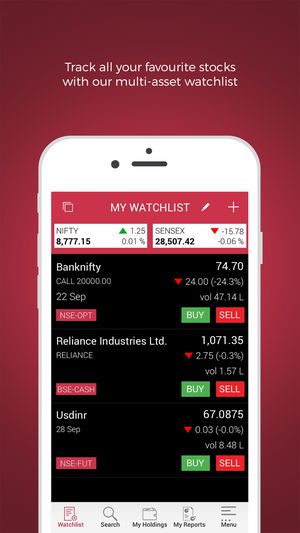

Artificial intelligence is one of the innovation drivers in today’s trading platform. Predictive analytics, fraud detection, automation, and hyper-personalization are among some of the areas where artificial intelligence has an impact.

1. Predictive Analytics

By looking at historical data, news feeds, and even sentiments on social media about the prediction of stock and cryptocurrency price movements, the tools from Trade Ideas and SigFig through AI algorithms can provide insights to enable predictions of market trends for a trader.

For example, in the great GameStop trading frenzy of 2021, AI-based systems detected unusual patterns in trading before this became widely known, giving users a tremendous advantage.

2. Automation by Robo-Advisors

Some even include Betterment and Wealthfront. Such systems are managed automatically, though by using AI, they will rebalance investments, reinvest dividends, and optimize financial strategies based on user-defined goals and risk tolerance.

3. Fraud Detection

Growing financial fraud everywhere is rendering AI-based systems of high value for protecting users and platforms. Major contributions of AI to enabling trading applications as more secure ones include real-time anomaly detection and flagging suspicious activities.

4. Hyper-personalization

Personalizing by AI in the users’ experience refers to personal tips on investments, personal insights, recommendations according to trading behaviors, and set goals.

Role of Blockchain in Trading Apps

While it seeks thorough data and the entire procedure involved in decision-making, Blockchain is necessary for transactions without jeopardizing such assets. All of these greatly influence the playground for cryptocurrency trading.

1. DEXs

DEX is a decentralized exchange and some examples are Uniswap, PancakeSwap etc with which people can now exchange cryptocurrencies without the requirement for a third party; due to its power base through blockchain’s in-built reliance on trust and transparency.

2. Smart Contracts

A smart contract is an agreement that can be written into the Blockchain, which automatically executes trades-doing transactions once certain conditions are satisfied thereby saving one from unnecessary costs and middlemen.

3. Secure Digital Wallets

To increase digital security, Blockchain uses advanced encryption. To extend protection to its users, Coinbase and its other leaders are using multi-signature and cold storage.

4. Real-time Trade Settlements

Settling typically takes 2-3 days on the old, traditional stock markets; just gets shortened down into seconds on blockchain, which enables speed and convenience.

The role of US-based mobile application development companies:

Experienced mobile application development companies in the USA have played a milestone role in developing AI and Blockchain-powered trading applications. Using technical capabilities with industry knowledge, innovation comes into play to develop a solution for traders. Why USA is a Forerunner in Innovation

This makes America a unique land to take the lead in such a revolution, with leading-edge technologies, brilliant developers, and developed financial systems. The trading platforms are remade and redefined with innovative features and simple designs from companies such as Next Olive Technologies, which is the leader in mobile application development.

Contributory Ideas of U.S. Developers

Integration of AI: Such trading applications have AI integration to support real-time analytics, sentiment analysis, and predictive algorithms.

Blockchain Expertise: US Companies take the top position in the world when it comes to Blockchain implementation on wallets, decentralized exchanges, and smart contract functionalities for security purposes.

Simple UI/UX: Since the complexity of trading is so vast, developers strive to make the user interface simple and user-centric.

Regulatory compliance: US-based developers navigate their legal landscape in creating financial applications that are entirely compliant with the laws and securities in place.

AI and Blockchain: Benefits to Stock and Crypto Traders

Data shows an exceptionally high integration of AI and Blockchain in trading applications for traders has many benefits such as:

Efficiency: Automated systems save time and effort for trading.

Accessibility: Features that only were accessible by the banks are now accessible to the individual trader.

Transparency: It gives transaction transparency through verifiable, tamper-proof evidence of all transactions.

Cost Savings: Decentralized platforms eliminate intermediaries, which means lowering transaction fees.

Challenges and Opportunities

The great promise of AI and Blockchain in trading apps must be met with challenges to be availed such as:

Regulatory uncertainty: The more the US Federal Government keeps devising rules about cryptocurrency and AI-based trading, the more flexibility developers would have to be.

Security Risks: Blockchain is inherently secure; however, the blockchain itself is not invulnerable to cyberattacks. Use advanced safeguards.

Market Volatility: Even though it may be able to predict trends, AI cannot eradicate the inherent risks of a financial market. One needs to be very cautious in trading after all such ups and downs because most have learned how to punch holes in every blockade and make perfect use of everything one has developed.

Future of Artificial Intelligence and Blockchain in Trading

As both these technologies continue their trajectory on maturity curves, it will reveal further larger breakthroughs in trading applications. Some of the leading trends that could be seen in the future are:

Advanced Predictive Analytics: AI algorithms will see more about market movements with high precision.

Tokenization of Assets: Blockchain will make it possible to tokenize traditional assets, and then even trade them; be it real estate or equities.

IoT connectivity: The trading platforms can be connected through IoT, wherein any user can achieve updates about information through smartwatches or voice assistants.

Conclusion

AI and Blockchain have ceased to improvise and change trading apps at the core. It would make tools more intelligent, secure, and transparent in the hands of traders in the United States. Mobile application development companies like Next Olive Technologies form the cutting edge of this revolution and bring innovative technology together with expertise to solve current and future needs that have been identified in the financial market. That just means the convergence of such technologies could open limitless opportunities in trading apps. It is at that stage where AI and Blockchain promise to give traders new powers to endow all and redefine systems that sit stock and crypto trading.