Trading cryptocurrency has grappled every single individual with intrigue. The arena shows huge promise through over 18,000 different cryptocurrencies, high-margin profits, and decentralization that offered freedom from the government.

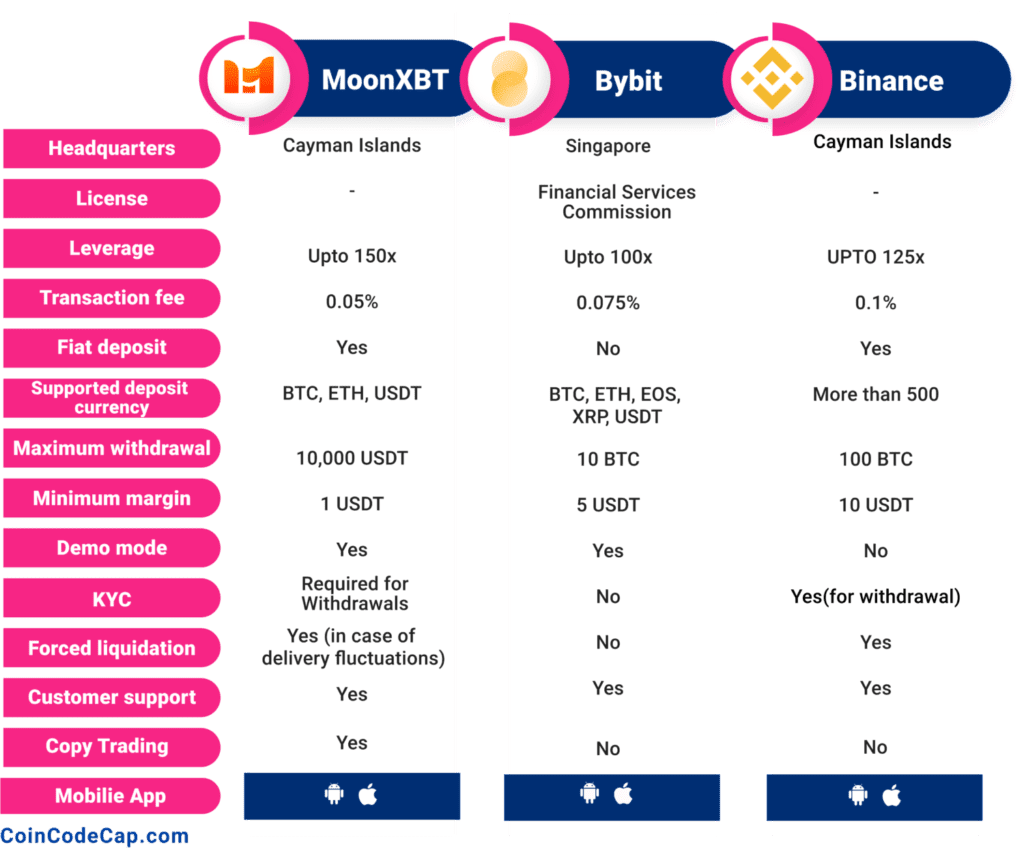

Here are some of the largest cryptocurrency exchanges based on their daily trade volume (in billion U.S. dollars).

However, as far as trading goes, cryptocurrency is still in its infancy and incredibly unpredictable. There is no set strategy and no one knows how it all works. This entails a certain level of inherent risks.

Naturally, beginners are bound to make mistakes when they are starting out, some of them common, some not so much. Here we discuss the mistakes that occur frequently but are definitely avoidable with prior knowledge. This should help you steer clear of traps that several novice crypto traders have fallen prey to.

Forgetting Your Wallet Password

Forgetting your wallet’s password is one of the most rookie crypto trading mistakes in the book. A large number of beginners assume that it will never happen to them. However, there are millions of traders out there who were locked out of their accounts holding large sums of crypto due to this fundamental mistake.

Once you forget your wallet password you can never access the wallet again. The heightened security that you obtained from blockchain and decentralization seems like a curse in such a situation. The crux is that you have to make sure you find a safe way of remembering passwords.

It is also an added advantage if you remember the passwords of the device it is hosted on as well. Even though the wallet is the most secure thing out there, the password is your responsibility. You have to handle these credentials carefully for accessing the wallet in the future.

Not Having a Healthy Diversification

It is important for crypto traders to achieve appropriate diversification in the bucket. The balance keeps you afloat in the wildly volatile crypto market. It can be a little tough in the beginning when you are still learning and reading about the different types of crypto coins and currencies. However, once you start getting the hang of the system you start having a better judgment of how to create a diverse crypto portfolio.

You may come across people who strongly believe in one coin or you may be one of them. But always remember to avoid the grave error of putting all your eggs in one basket. You can invest 75% in that one coin you truly believe and the other 25% in other coins. Diversification of the technologies behind the coins can also be beneficial for your trading practices. For example, Bitcoin works on the principle of Proof of Work (PoW). So if you have invested in that coin, look for coins that work on other principles.

There is a very tricky balance here though. You have to be careful to avoid over-diversifying as well. You might think that investing in several different crypto coins will lead to better outcomes, but it only ends up confusing you. It becomes extremely difficult to track too many investments and you end up making some irresponsible decisions in the midst of this chaos. Besides, investing in too many coins just slows down the growth of your investments’ value. This is because your cash may get blocked in cryptos that aren’t easily traded or show limited growth.

Skipping Paper Trading

The new and shiny world of cryptocurrencies seems really exciting for everyone. But before you dip your toes in the trades using your money, you should try paper-trading for a while. This method allows the users to perform simulated trades in a virtual transactional environment without the use of real money.

There are several risks and frauds involved in crypto trading. After all, just have a look at the graph of total amounts stolen over the years via cryptocurrency theft.

So paper-trading will give you a better idea of the process and help you prepare for the trades using the real money.

The market fluctuates on a whim and rash initial trades can lead to some extremely costly mistakes. On top of that, the U.S. has seen over 80,000 cryptocurrency frauds in 2020 alone. Therefore you should never skip paper-trading and gain ample experience without the risk of losing any funds.

This practice helps you get a sense of how the market stirs and identify the ones that are worth investing in. There, never skip paper trading if you want to save yourself from some major losses down the road.

Not Keeping Track of Your Transactions

If you are a beginner at crypto trading and wish to become a successful trader you need to record your trades. Keeping a journal that has information about your trades helps you plan better by seeing the big picture. You can find answers to several trading patterns and strategize your moves accordingly. In addition to that, keeping such a journal will help you hold yourself accountable for your actions. It is a great way to learn from your mistakes and hone the practices that help you succeed.

You can find several apps and platforms that will help you keep track of the trades from different accounts simultaneously. However, it is not necessary to have a digital record, you can just as easily grab a pen and diary to maintain a ledge of crypto transactions.

Trading Without a Stop Loss

Beginners in crypto trading might often have a knee-jerk reaction to losses. The experts observed several cases where the beginners trade emotionally, face a loss, get even more invested emotionally, and partake in revenge trading. This leads to a very vicious cycle.

Accepting a loss and moving on to the next trade is one quality that almost all investors (not just crypto) would advocate for. Setting a stop loss can help you take the right step in that direction. You should avoid moving it when the trade goes against you as well, to avoid blowing up your account.

You can set a stop-loss after a thorough risk assessment and gauging how much you can afford to lose if the trade starts heading south. This way you are taking calculated risks at all points and your judgments are not ruled by your emotions.

Wrapping Up

Crypto trading can seem hard at first. But as you keep trading and avoiding these mistakes, slowly the confusing decisions start making sense. You have to make sure that you are appropriately capitalized and going through a step-by-step learning curve. You can create a long-term plan and stick to it religiously to unlock the maximum potential of crypto trading. This way you will become adept in risk management and make profitable trades with time.