An Initial Public Offering or IPO is the initial sale of stock made by a company to the public. Before the company sells an IPO, it is considered private, with a small circle of shareholders, made up of most of the initial investors (founders, their friends, and/or family) and professional investors (venture capitalists, angel investors, and such). Unless the company offers its stock to the public for sale, it remains unavailable to the masses; ergo the public cannot invest in it.

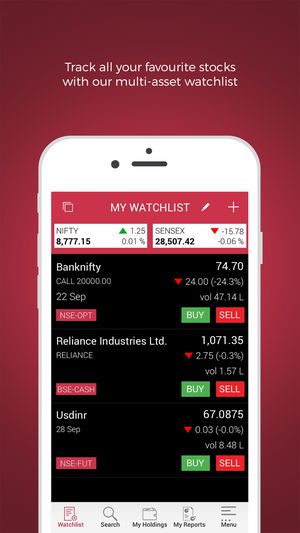

Once the company becomes public, however, it implies they have already sold a portion of their shares to the public. This is why an IPO sometimes also becomes a euphemism for ‘going public’. Money for the company can be raised by either issuing debt or equity. Say the company decides to choose the route of the equity, then the first offering of this kind, of equity shares to the public, via listing the shares the in the stock markets is called an IPO. 5Paisa offers you a way to invest in IPOs.

You can choose to apply for an IPO in the following ways:

Through the mobile app

- Go to the menu

- Click on the Trade button

- Select the option of IPO

- Click on the kind of IPO you wish to choose

- Click on Apply

- Enter the quantity

- Enter the amount

- Click on Confirm

Through Trade Station/Website

- Select the option marked Markets

- Click on IPO

- Select Apply

- Click on Investor Type

- Select the Bank

- Enter the quantity

- Select the price

- Click on Pay Now

Once the above procedure has been fulfilled in completion, the form and the bid confirmation slip will be sent to you on the registered E-Mail ID. The application form has to be completed, signed, and submitted at the ASBA branch to finish the procedure.

Download 5Paisa App: Android / Apple

For one particular IPO, one can bid three times in a single application form. However, should you wish to bid again, the procedure is quite simple. Just send a request through your registered E-Mail ID at support@5paisa.com stating that you wish to consider or modify your earlier application, though this process will be considered an offline request. In accordance with this, a new application form will be created, however, you cannot bid again if already one application has been generated.

Note– for a single IPO, the maximum that a retail investor can bad would be Rs. 2 lakhs.

You will be alerted through a text message if you have received a share in the IPO. If you have submitted a Power of Attorney (POA) form, 5Paisa requires T+2 days to get your POA activated. Once your POA is activated, you need to look into the trade station.

To do that Login in to the Trade Station

- Go to My Account

- DP

- Select Holdings

Once you have received the POA form, it will take two further days to map into your account. After mapping, IPO holdings will show in your holding for trading.

You can check whether your POA is activated or not by logging in to your Trade Station

- Go to My Account

- Click on My A/c Summary

- Finally, Click on Show

The Final Words

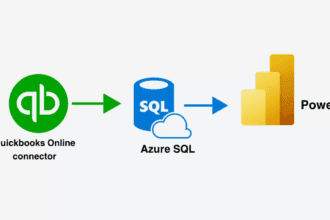

5Paisa offers online stock trading at the most minimum value in the country. 5Paisa.com is supported by one of the leading financial services companies in the country, IIFL. With a loyal consumer base of 2.9 million users, 5Paisa deals in various business segments, including IPOs. 5Paisa is concerned with the following objectives- experience of the financial markets, gauging customer needs, and expertise in implementing complex technological solutions enabling the customer to invest at an unimaginably low price.