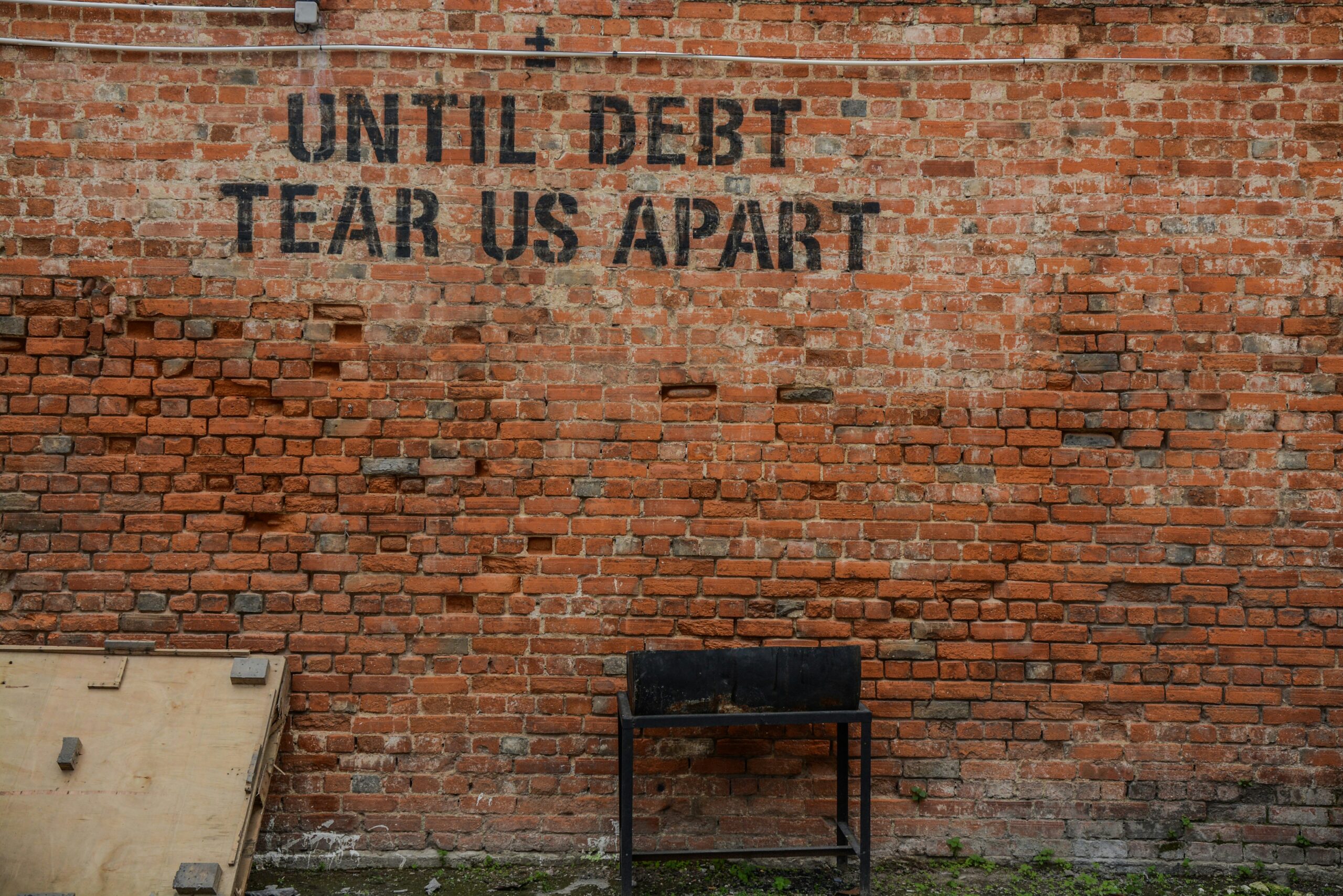

In addition to the practical and financial implications of owing a significant amount of debt, there are unseen aspects of debt as well. Some consumers with a debt problem may experience emotional distress. Financial struggles can affect personal relationships and many other aspects of life. While debt settlement is one way to address the financial burden, understanding and addressing the emotional toll is equally important.

The Emotional Impact of Debt

Debt doesn’t just weigh on your wallet; it can weigh heavily on your mind and emotions as well. Here’s how:

- Stress and Anxiety: Constantly worrying about how to make ends meet and pay off debts can lead to significant stress and anxiety. This can manifest in physical symptoms such as headaches, insomnia, and a weakened immune system.

- Depression: The feeling of being trapped in debt can lead to depression. Individuals may feel hopeless about their financial situation and struggle to see a way out.

- Shame and Guilt: Many people with debt feel ashamed or guilty about their financial situation. This can prevent them from seeking help and exacerbate their problems.

Impact on Personal Relationships

Debt can strain relationships in various ways:

- Marital Strain: Financial issues are one of the leading causes of marital stress and divorce. Disagreements about spending habits, budgeting, and debt repayment can create tension between partners.

- Family Dynamics: Debt can affect the entire family, leading to arguments and a lack of harmony at home. Children might sense the tension and worry about their family’s financial stability.

- Social Isolation: People struggling with debt might avoid social situations due to a lack of funds or embarrassment about their financial situation, leading to isolation and loneliness.

Finding Financial Relief

Addressing the practical aspects of debt is crucial to alleviating the emotional and relational toll it takes. Here are some options:

- Debt Settlement: This involves negotiating with creditors to reduce the total amount owed. While this can provide significant relief, it may also impact your credit score. It’s important to weigh the pros and cons and consider consulting a financial advisor.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify payments and reduce the total amount paid in interest. This can make the debt more manageable and less stressful.

- Credit Counseling: Nonprofit credit counseling agencies can help you create a budget, develop a debt management plan, and negotiate with creditors. This can provide a structured path to becoming debt-free.

Seeking Emotional Support

In addition to finding financial solutions, seeking emotional support is crucial:

- Therapy and Counseling: Talking to a mental health professional can help you cope with the stress and emotional impact of debt. Therapy can provide strategies for managing anxiety, depression, and relationship issues related to financial stress.

- Support Groups: Joining a support group for individuals dealing with debt can provide a sense of community and understanding. Sharing experiences and strategies with others in similar situations can be incredibly empowering.

- Open Communication: Being open and honest about your financial situation with loved ones can reduce feelings of shame and isolation. This can also lead to practical support and collaborative problem-solving.

Building a Healthier Financial Future

Once you’ve addressed your current debt, it’s important to build habits that prevent future financial distress:

- Budgeting: Create a realistic budget that accounts for all your income and expenses. Stick to it and adjust as necessary to avoid overspending.

- Emergency Fund: Build an emergency fund to cover unexpected expenses. This can prevent the need to take on debt in the future.

- Financial Education: Educate yourself about personal finance. Understanding how to manage money, save, and invest can provide long-term financial stability.

Conclusion

The unseen aspects of debt are just as important as the financial implications. Stress, anxiety, and relationship strain are common but often overlooked consequences of debt. By addressing both the financial and emotional toll of debt, individuals can find comprehensive relief. Options like debt settlement and consolidation can provide practical solutions while seeking emotional support through therapy and open communication can help manage the mental and relational impact. Building healthy financial habits for the future is key to maintaining long-term stability and well-being.