As the world becomes more digital, fraud patterns are ever-evolving, and there are more sophisticated and numerous risks to customers, online retailers, and financial services companies than ever before. Over $48 billion will be spent on e-commerce fraud internationally in 2023, up only from over $41 billion in 2022, according to projections. The rise in online payments and purchases brought on by the epidemic, the prevalence of malware and bots that gather user information on the web, and social manipulation scams that prey on human weaknesses are just a few of the factors contributing to this rise in fraud expenses.

Fraud required meticulous planning and stealth in the pre-digital era, but today, the instruments needed to commit fraud are widely accessible online, decreasing the entry barrier. With online stores, digital wallets, and the continuous automation of almost everything, cybercriminals have a greater target and access to cutting-edge tools and technology that can help them break into companies and assault customer accounts.

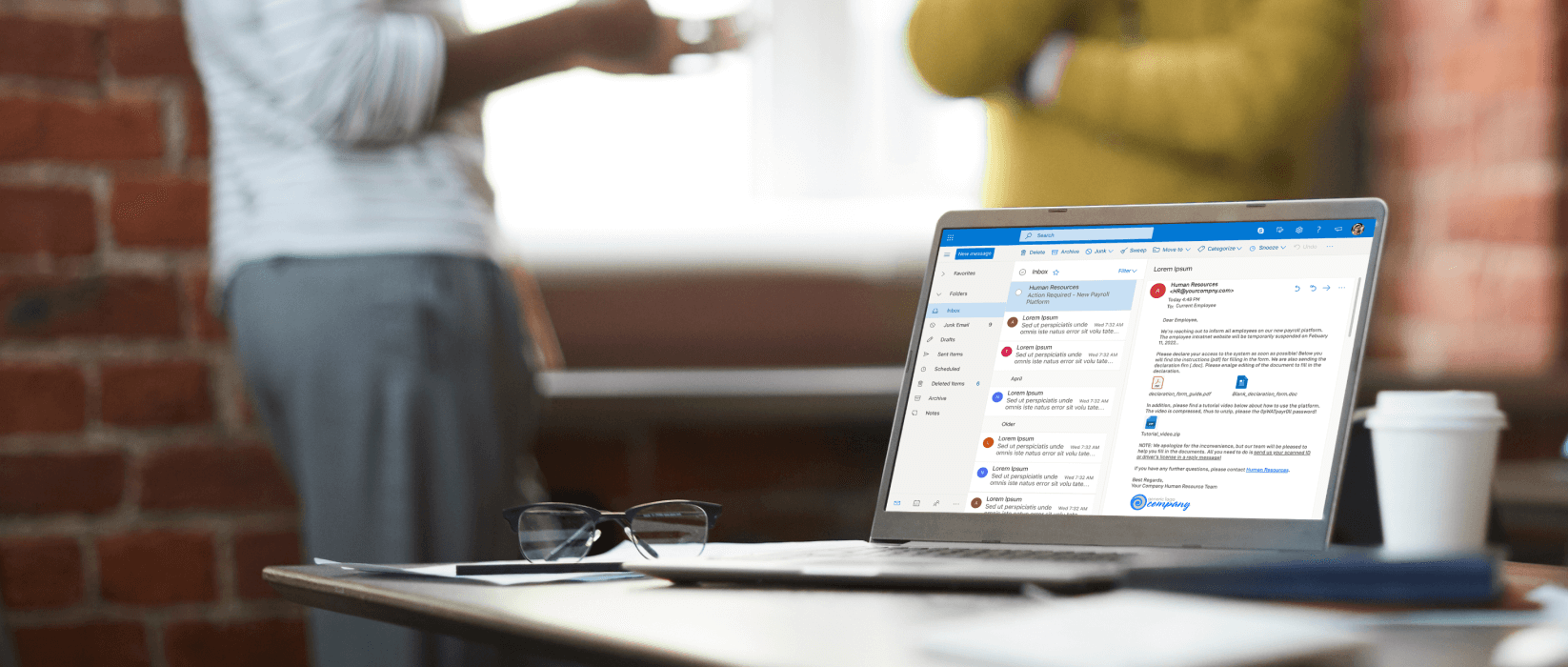

Various types of payment fraud, such as Phishing, Triangulation, E-commerce fraud, Identity Theft, Merchant Identity Theft, Credit Card Fraud, etc. It would help if you had a payment fraud detection solution for your company so that you can prevent fraud from happening.

Study our suggestions for preventing fraud in 2023 to stay on top of the most recent risks and vulnerabilities hackers will use to target financial services and e-commerce companies this year.

Align And Combine Various Security Measures To Combat Fraud More Successfully While Maintaining A Positive Client Experience.

Cybersecurity, customer identity, access management (CIAM), fraud detection, and authenticating teams across merchant and financial services firms must collaborate more effectively. Teams working in silos and overly reliant on CAPTCHA or multi-factor authentication (MFA) procedures have led to vulnerabilities that criminals can exploit. These methods frequently disrupt user experience without taking into account the level of risk posed by the login session.

Retailers and financial services companies may implement an agile, dependable, relatively high fraud detection strategy without detrimental impact on the user experience thanks to a transparent and ongoing risk-based authentication approach.

Provide Comprehensive Visibility And Data Across The Customer Experience In Traditional Omni-Touchpoint Fraud Prevention Techniques.

This plan should concentrate on three crucial but frequently ignored areas:

Start with the first channel interaction: Pay attention to your consumers’ actions when they enter a channel or open an account. This should increase awareness of client-side assaults like formjacking and digital skimming, frequently used to gather login passwords and credit card information while creating new accounts, ultimately resulting in account takeover and crime.

Evaluate Third-party API Integrations: Retailers and banking sector companies must ensure API protection is part of their security policies in addition to online and mobile apps.

The same types of threats that target web apps also affect APIs, including abuse and vulnerabilities that result in data breaches and fraud, as well as unexpected danger from third-party ecosystems and integrations.

Examine The Possibility Of Fraud In Card Not Present (CNP) Transactions: Businesses who provide novel services like proximity-based checkout, purchase online and pick up in-store (BOPIS), and purchase now, pay later (BNPL) need to be aware of the dangers involved and take precautions to prevent fraud. Gaining knowledge about fraudulent behavior patterns and disseminating it through all channels are part of this.

In A Downturn, Be Watchful For New Friendly Fraud Challenges.

“Fake friendly fraud,” which happens when criminals create phony identities to impersonate real customers and then the transaction with no aim of paying for the goods they buy, is a significant new sort of friendly fraud that businesses can expect to see an increase during a recession. To open new accounts and evade being denied by a deny list, fake friendly fraudulent practitioners can effortlessly recycle stolen identity information and build new synthetic identities. This allows them to game and overcome preventive attempts. BNPL program abuse, loyalty point and return fraud scams, and burst-out fraud are some friendly fraud activities.

By utilizing insights from behavioral biometric patterns enhanced with machine learning that give similar fraud and security teams knowledge into compromised accounts, you may prevent the enrolment of new accounts using synthetic identities.

Be Ready For New Digital Payment Rules Under The EU’s Payment Services Directive 3 (PSD3).

Since the Payment Services Directive’s initial introduction in 2018, the risk, payments, and regulation situation for retailers and banks have undergone a significant upheaval. Businesses and banks should make a list of the new services, platforms, and payment choices they have lately embraced in order to get ready for the stricter rules of PSD3. For instance, do you currently accept cryptocurrency payments and digital wallets? How many brand-new APIs in various formats from outside vendors have you incorporated into your platforms and websites?

The existing API and authenticating strategy used by retailers and financial services firms need to evolve beyond only a compliance-risk mindset. They must proactively foresee and control the whole range of fraud and security risks the current API ecosystem brings.

Conclusion:

Organizations establish potential new points of vulnerability as their third-party ecosystem grows, which increases the risk of attacks and financial fraud. These attacks could be challenging to identify since your organization frequently lacks a methodology for conducting security evaluations. Yet, retailers and different e-commerce industries can have improved protection with payment fraud detection, returns abuse prevention, and PSD2 SCA compliance solutions, preventing loss to the business, ensuring a positive shopping experience for customers, and assuring data security and payment security.